Invoicing and membership fees

The Entrepreneur Fund’s membership fee is 1.7 per cent of the annual work income exceeding € 9,600, which the policy is based on. Use our calculator to determine the cost of membership based on your chosen level of insurance.

The maximum level for your insurance with the Entrepreneur Fund equals the total of your annual work income, which your (YEL, MYEL, TyEL) insurances are based on. Accordingly, you can base your insurance on any amount in euro equal to or exceeding € 15,128.

You should take out unemployment insurance to match your YEL, MYEL or TyEL income right from the start, since any increases exceeding 20 per cent made later will take 15 months to gain full effect.

Membership fees

You can pay your membership fees according to your preference in either one, four or twelve installments. Invoices for the ongoing year are mailed out between January and February for members who have paid the preceding years membership fees in full. New members will receive invoices within 2 weeks of joining the fund.

If you have misplaced your invoices or have not received them in the first place, please contact our customer service.

You can switch to e-invoices delivered directly to your online banking account. To start receiving electronic invoices, please select the Entrepreneur Fund from the list of e-invoice providers in your online banking account, where we are listed as Yrittäjän työttömyyskassa. To ensure the confidentiality of your membership and member information, we will only send e-invoices to your personal online bank account and not, for example, to your company’s online bank.

New members start paying membership fees starting from the first day of the month during which they joined the Entrepreneur Fund.

Membership fees are tax deductible

The membership fee is fully deductible in personal taxation. We send information on membership fees paid each year directly to the Tax Authority.

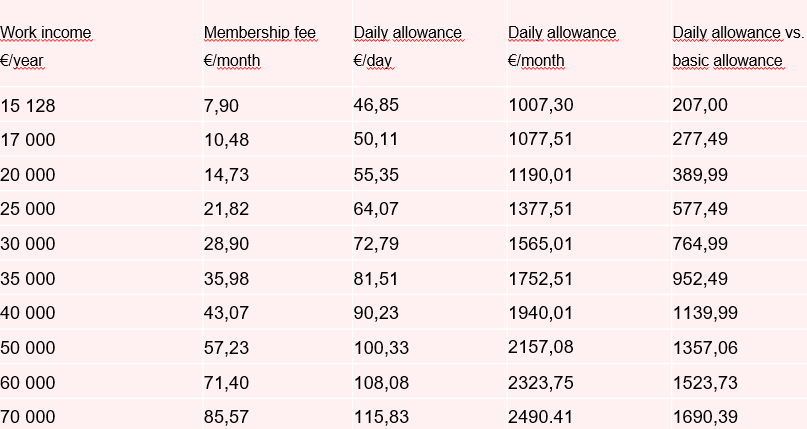

Examples of income levels, membership fees and daily allowances in 2025

Unemployment allowances paid to entrepreneurs by the Entrepreneur Fund comprise basic unemployment allowance, earnings-related unemployment allowance. In 2025, the basic unemployment allowance is 37,21 euros. The earnings-related unemployment allowance equals 45 per cent of the difference between your daily salary and the basic unemployment allowance. If your monthly income exceeds € 3 534,95, your earnings-related unemployment allowance equals 20 per cent for the part that that your income exceeds this level. Unemployment allowances are taxable income.